ARIMA: autoregresivo integrado de medias móviles

Para series de tiempo no estacionarias.

La parte de integrado en ARIMA significa que se usará el número de diferencias no estacionales que debemos examinar para establecer estacionariedad. Los datos se transformará para que sean estacionarios. Esta transformación será con las diferencias \(\Delta x_t\).

ARIMA(p,d,q)

\(p\): Componente autoregresiva del modelo \((AR)\).

\(d\): orden de integración. Es el número de veces que se debe integrar la serie de tiempo para obtener la estacionariedad.

\(q\): Componente de medias móviles \((MA)\).

Los modelos ARIMA(p,d,q) son un modelo ARMA(p,q) aplicado a una nueva serie de tiempo generada mediante la integración, es decir, por las diferencias y que esta nueva serie de tiempo es estacionaria.

Se empezará con el modelo ARIMA(1,1,1), luego se analizan los residuos, si no son Ruido Blanco, se evalúan modelos más complejos.

Recordar que por cada integración se perderá una observación.

\(ARIMA(p,0,q)= ARMA(p,q)\)

ARIMA(1,1,1)

import pandas as pd

datos = pd.read_csv('Precio.csv', sep=';', decimal=',')

datos.Fecha = pd.to_datetime(datos.Fecha, dayfirst = True)

datos.set_index('Fecha', inplace=True)

ARIMA(1,1,1)

from statsmodels.tsa.arima_model import ARIMA

import warnings

warnings.filterwarnings("ignore")

model_ar_1_i_1_ma_1 = ARIMA(datos.Precio, order=(1,1,1))

results_ar_1_i_1_ma_1 = model_ar_1_i_1_ma_1.fit()

results_ar_1_i_1_ma_1.summary()

| Dep. Variable: | D.Precio | No. Observations: | 5816 |

|---|---|---|---|

| Model: | ARIMA(1, 1, 1) | Log Likelihood | -27010.235 |

| Method: | css-mle | S.D. of innovations | 25.158 |

| Date: | Thu, 15 Jul 2021 | AIC | 54028.469 |

| Time: | 05:54:51 | BIC | 54055.143 |

| Sample: | 1 | HQIC | 54037.747 |

| coef | std err | z | P>|z| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| const | 0.0408 | 0.364 | 0.112 | 0.911 | -0.672 | 0.753 |

| ar.L1.D.Precio | -0.2638 | 0.059 | -4.472 | 0.000 | -0.379 | -0.148 |

| ma.L1.D.Precio | 0.3930 | 0.056 | 7.080 | 0.000 | 0.284 | 0.502 |

| Real | Imaginary | Modulus | Frequency | |

|---|---|---|---|---|

| AR.1 | -3.7903 | +0.0000j | 3.7903 | 0.5000 |

| MA.1 | -2.5443 | +0.0000j | 2.5443 | 0.5000 |

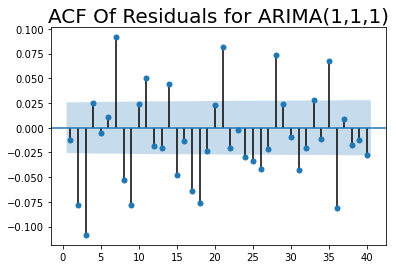

Residuales del ARIMA(1,1,1)

import statsmodels.graphics.tsaplots as sgt

import matplotlib.pyplot as plt

residuos_ARIAM111 = results_ar_1_i_1_ma_1.resid

sgt.plot_acf(residuos_ARIAM111, zero = False, lags = 40)

plt.title("ACF Of Residuals for ARIMA(1,1,1)",size=20)

plt.show()

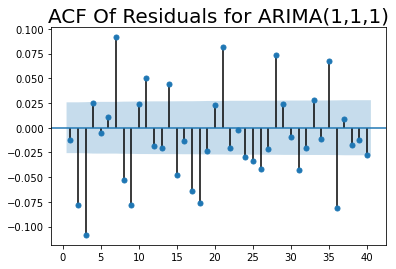

sgt.plot_acf(residuos_ARIAM111, zero = False, lags = 40)

plt.title("ACF Of Residuals for ARIMA(1,1,1)",size=20)

plt.show()

Evaluación de varios modelos de ARIMA

Primero se deben calcular todos los modelos y escoger los que tienen todos los coeficientes significativos. Este paso no se ha realizado, se evaluarán unos modelos que estamos suponiendo que tienen todos los coeficientes significativos.

model_ar_1_i_1_ma_2 = ARIMA(datos.Precio, order=(1,1,2))

results_ar_1_i_1_ma_2 = model_ar_1_i_1_ma_2.fit()

model_ar_1_i_1_ma_3 = ARIMA(datos.Precio, order=(1,1,3))

results_ar_1_i_1_ma_3 = model_ar_1_i_1_ma_3.fit()

model_ar_2_i_1_ma_1 = ARIMA(datos.Precio, order=(2,1,1))

results_ar_2_i_1_ma_1 = model_ar_2_i_1_ma_1.fit()

model_ar_3_i_1_ma_1 = ARIMA(datos.Precio, order=(3,1,1))

results_ar_3_i_1_ma_1 = model_ar_3_i_1_ma_1.fit()

model_ar_3_i_1_ma_2 = ARIMA(datos.Precio, order=(3,1,2))

results_ar_3_i_1_ma_2 = model_ar_3_i_1_ma_2.fit(start_ar_lags=5)

print("ARIMA(1,1,1): \t LL = ", results_ar_1_i_1_ma_1.llf, "\t AIC = ", results_ar_1_i_1_ma_1.aic)

print("ARIMA(1,1,2): \t LL = ", results_ar_1_i_1_ma_2.llf, "\t AIC = ", results_ar_1_i_1_ma_2.aic)

print("ARIMA(1,1,3): \t LL = ", results_ar_1_i_1_ma_3.llf, "\t AIC = ", results_ar_1_i_1_ma_3.aic)

print("ARIMA(2,1,1): \t LL = ", results_ar_2_i_1_ma_1.llf, "\t AIC = ", results_ar_2_i_1_ma_1.aic)

print("ARIMA(3,1,1): \t LL = ", results_ar_3_i_1_ma_1.llf, "\t AIC = ", results_ar_3_i_1_ma_1.aic)

print("ARIMA(3,1,2): \t LL = ", results_ar_3_i_1_ma_2.llf, "\t AIC = ", results_ar_3_i_1_ma_2.aic)

ARIMA(1,1,1): LL = -27010.234621625288 AIC = 54028.469243250576

ARIMA(1,1,2): LL = -26970.45408581454 AIC = 53950.90817162908

ARIMA(1,1,3): LL = -26951.814421818075 AIC = 53915.62884363615

ARIMA(2,1,1): LL = -26960.455943244346 AIC = 53930.91188648869

ARIMA(3,1,1): LL = -26954.471631818797 AIC = 53920.94326363759

ARIMA(3,1,2): LL = -26954.419566101034 AIC = 53922.83913220207

De los modelos evaluados, el mejor es el ARIMA(1,1,3) por tener mayor Log-Verosimilitud y menor AIC.

LLR Test

Sin embargo, los modelos ARIMA(1,1,1) y ARIMA(1,1,2) están anidados al modelo ARIMA(1,1,3), se hará comparación si el modelo ARIMA(1,1,3) es mejor que los dos anteriores.

def LLR_test(mod_1, mod_2, DF = 1):

L1 = mod_1.llf

L2 = mod_2.llf

LR = (2*(L2-L1))

p = chi2.sf(LR, DF).round(3)

return p

from scipy.stats.distributions import chi2

print("\nLLR test p-value = " + str(LLR_test(results_ar_1_i_1_ma_2, results_ar_1_i_1_ma_3)))

LLR test p-value = 0.0

print("\nLLR test p-value = " + str(LLR_test(results_ar_1_i_1_ma_1, results_ar_1_i_1_ma_3, DF = 2)))

LLR test p-value = 0.0

El modelo ARIMA(1,1,3) si es mejor que los dos modelos que están anidados con este.

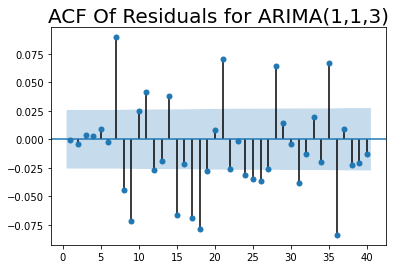

Residuales del modelo ARIMA(1,1,3)

residuales_ARIMA_113 = results_ar_1_i_1_ma_3.resid

sgt.plot_acf(residuales_ARIMA_113, zero = False, lags = 40)

plt.title("ACF Of Residuals for ARIMA(1,1,3)", size=20)

plt.show()

Se podría evaluar modelos más complejos hasta el ARIMA(7,1,7).

model_ar_5_i_1_ma_5 = ARIMA(datos.Precio, order=(5,1,5))

results_ar_5_i_1_ma_5 = model_ar_5_i_1_ma_5.fit(start_ar_lags=11)

results_ar_5_i_1_ma_5.summary()

| Dep. Variable: | D.Precio | No. Observations: | 5816 |

|---|---|---|---|

| Model: | ARIMA(5, 1, 5) | Log Likelihood | -26878.553 |

| Method: | css-mle | S.D. of innovations | 24.593 |

| Date: | Thu, 15 Jul 2021 | AIC | 53781.106 |

| Time: | 05:55:02 | BIC | 53861.127 |

| Sample: | 1 | HQIC | 53808.939 |

| coef | std err | z | P>|z| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| const | 0.0411 | 0.332 | 0.124 | 0.901 | -0.609 | 0.692 |

| ar.L1.D.Precio | -0.3205 | 0.042 | -7.665 | 0.000 | -0.402 | -0.239 |

| ar.L2.D.Precio | -0.2270 | 0.033 | -6.855 | 0.000 | -0.292 | -0.162 |

| ar.L3.D.Precio | -0.4506 | 0.030 | -15.195 | 0.000 | -0.509 | -0.393 |

| ar.L4.D.Precio | -0.3947 | 0.034 | -11.511 | 0.000 | -0.462 | -0.327 |

| ar.L5.D.Precio | -0.6894 | 0.032 | -21.787 | 0.000 | -0.751 | -0.627 |

| ma.L1.D.Precio | 0.4184 | 0.040 | 10.561 | 0.000 | 0.341 | 0.496 |

| ma.L2.D.Precio | 0.1603 | 0.029 | 5.588 | 0.000 | 0.104 | 0.216 |

| ma.L3.D.Precio | 0.3645 | 0.027 | 13.655 | 0.000 | 0.312 | 0.417 |

| ma.L4.D.Precio | 0.4863 | 0.030 | 16.124 | 0.000 | 0.427 | 0.545 |

| ma.L5.D.Precio | 0.7429 | 0.029 | 25.497 | 0.000 | 0.686 | 0.800 |

| Real | Imaginary | Modulus | Frequency | |

|---|---|---|---|---|

| AR.1 | 0.6833 | -0.7607j | 1.0225 | -0.1335 |

| AR.2 | 0.6833 | +0.7607j | 1.0225 | 0.1335 |

| AR.3 | -1.0478 | -0.0000j | 1.0478 | -0.5000 |

| AR.4 | -0.4456 | -1.0609j | 1.1506 | -0.3133 |

| AR.5 | -0.4456 | +1.0609j | 1.1506 | 0.3133 |

| MA.1 | 0.6951 | -0.7411j | 1.0161 | -0.1301 |

| MA.2 | 0.6951 | +0.7411j | 1.0161 | 0.1301 |

| MA.3 | -1.0380 | -0.0000j | 1.0380 | -0.5000 |

| MA.4 | -0.5034 | -1.0013j | 1.1207 | -0.3241 |

| MA.5 | -0.5034 | +1.0013j | 1.1207 | 0.3241 |

print("\nLLR test p-value = " + str(LLR_test(results_ar_1_i_1_ma_3, results_ar_5_i_1_ma_5)))

LLR test p-value = 0.0

El ARIMA(5,1,5) es mejor que el ARIMA(1,1,3)

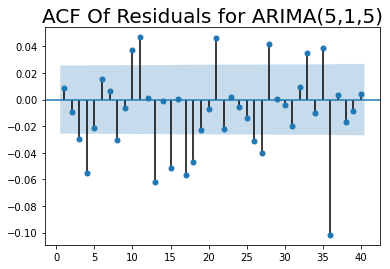

Residuales del modelo ARIMA(5,1,5)

residuales_ARIMA_515 = results_ar_5_i_1_ma_5.resid

sgt.plot_acf(residuales_ARIMA_515, zero = False, lags = 40)

plt.title("ACF Of Residuals for ARIMA(5,1,5)", size=20)

plt.show()

Integración \(d\)

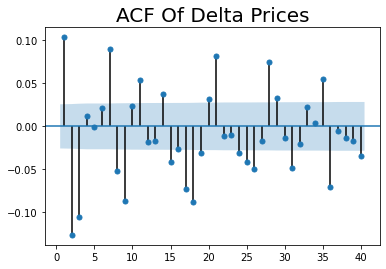

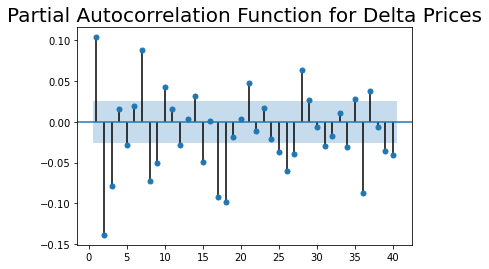

Se calculará la primer diferencia de los precios y se hará la prueba D-F para determinar si la nueva serie de tiempo es estacionaria o no.

Primera diferencia

datos['delta_prices']=datos.Precio.diff(1)

datos.head()

| Precio | delta_prices | |

|---|---|---|

| Fecha | ||

| 2003-03-01 | 72.412500 | NaN |

| 2003-03-02 | 72.837083 | 0.424583 |

| 2003-03-03 | 70.103750 | -2.733333 |

| 2003-03-04 | 70.770417 | 0.666667 |

| 2003-03-05 | 69.153750 | -1.616667 |

import statsmodels.tsa.stattools as sts

sts.adfuller(datos.delta_prices[1:])

(-14.940985509998315,

1.3227142701322909e-27,

34,

5781,

{'1%': -3.431481673763484,

'5%': -2.8620400923019074,

'10%': -2.5670361971807805},

53352.0028917936)

sgt.plot_acf(datos.delta_prices[1:], zero = False, lags = 40)

plt.title("ACF Of Delta Prices", size=20)

plt.show()

sgt.plot_pacf(datos.delta_prices[1:], lags = 40, alpha = 0.05, zero = False , method = ('ols'))

plt.title("Partial Autocorrelation Function for Delta Prices",size=20)

plt.show()

A continuación se mostrará una prueba de que una ARMA(1,1) sobre la primera diferencia de la serie de tiempo es igual a una ARIMA(1,1) sobre la serie de tiempo.

model_delta_ar_1_i_1_ma_1 = ARIMA(datos.delta_prices[1:], order=(1,0,1))

results_delta_ar_1_i_1_ma_1 = model_delta_ar_1_i_1_ma_1.fit()

results_delta_ar_1_i_1_ma_1.summary()

| Dep. Variable: | delta_prices | No. Observations: | 5816 |

|---|---|---|---|

| Model: | ARMA(1, 1) | Log Likelihood | -27010.235 |

| Method: | css-mle | S.D. of innovations | 25.158 |

| Date: | Thu, 15 Jul 2021 | AIC | 54028.469 |

| Time: | 05:55:05 | BIC | 54055.143 |

| Sample: | 0 | HQIC | 54037.747 |

| coef | std err | z | P>|z| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| const | 0.0408 | 0.364 | 0.112 | 0.911 | -0.672 | 0.753 |

| ar.L1.delta_prices | -0.2638 | 0.059 | -4.472 | 0.000 | -0.379 | -0.148 |

| ma.L1.delta_prices | 0.3930 | 0.056 | 7.080 | 0.000 | 0.284 | 0.502 |

| Real | Imaginary | Modulus | Frequency | |

|---|---|---|---|---|

| AR.1 | -3.7903 | +0.0000j | 3.7903 | 0.5000 |

| MA.1 | -2.5443 | +0.0000j | 2.5443 | 0.5000 |

model_ar_1_i_1_ma_1 = ARIMA(datos.Precio, order=(1,1,1))

results_ar_1_i_1_ma_1 = model_ar_1_i_1_ma_1.fit()

results_ar_1_i_1_ma_1.summary()

| Dep. Variable: | D.Precio | No. Observations: | 5816 |

|---|---|---|---|

| Model: | ARIMA(1, 1, 1) | Log Likelihood | -27010.235 |

| Method: | css-mle | S.D. of innovations | 25.158 |

| Date: | Thu, 15 Jul 2021 | AIC | 54028.469 |

| Time: | 05:55:06 | BIC | 54055.143 |

| Sample: | 1 | HQIC | 54037.747 |

| coef | std err | z | P>|z| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| const | 0.0408 | 0.364 | 0.112 | 0.911 | -0.672 | 0.753 |

| ar.L1.D.Precio | -0.2638 | 0.059 | -4.472 | 0.000 | -0.379 | -0.148 |

| ma.L1.D.Precio | 0.3930 | 0.056 | 7.080 | 0.000 | 0.284 | 0.502 |

| Real | Imaginary | Modulus | Frequency | |

|---|---|---|---|---|

| AR.1 | -3.7903 | +0.0000j | 3.7903 | 0.5000 |

| MA.1 | -2.5443 | +0.0000j | 2.5443 | 0.5000 |

SARIMA(p,d,q)(P,D,Q,s)

SARIMA-Seasonal Autoregressive Integrated Moving Averages

from statsmodels.tsa.statespace.sarimax import SARIMAX

model_sarima = SARIMAX(datos.Precio, order=(1,0,1), seasonal_order = (2,0,1,2))

results_sarima = model_sarima.fit()

results_sarima.summary()

| Dep. Variable: | Precio | No. Observations: | 5817 |

|---|---|---|---|

| Model: | SARIMAX(1, 0, 1)x(2, 0, 1, 2) | Log Likelihood | -26974.805 |

| Date: | Thu, 15 Jul 2021 | AIC | 53961.610 |

| Time: | 05:55:09 | BIC | 54001.621 |

| Sample: | 0 | HQIC | 53975.526 |

| - 5817 | |||

| Covariance Type: | opg |

| coef | std err | z | P>|z| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| ar.L1 | 0.9949 | 0.001 | 1319.143 | 0.000 | 0.993 | 0.996 |

| ma.L1 | 0.1061 | 0.003 | 40.096 | 0.000 | 0.101 | 0.111 |

| ar.S.L2 | 0.8309 | 0.020 | 42.567 | 0.000 | 0.793 | 0.869 |

| ar.S.L4 | 0.0987 | 0.004 | 22.085 | 0.000 | 0.090 | 0.108 |

| ma.S.L2 | -0.9498 | 0.019 | -48.766 | 0.000 | -0.988 | -0.912 |

| sigma2 | 623.3489 | 1.583 | 393.688 | 0.000 | 620.246 | 626.452 |

| Ljung-Box (Q): | 442.39 | Jarque-Bera (JB): | 19183877.49 |

|---|---|---|---|

| Prob(Q): | 0.00 | Prob(JB): | 0.00 |

| Heteroskedasticity (H): | 34.65 | Skew: | -6.00 |

| Prob(H) (two-sided): | 0.00 | Kurtosis: | 284.08 |

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).

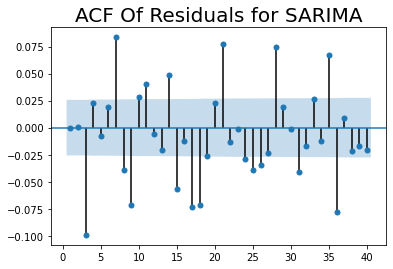

residuales_SARIMA = results_sarima.resid

sgt.plot_acf(residuales_SARIMA, zero = False, lags = 40)

plt.title("ACF Of Residuals for SARIMA", size=20)

plt.show()